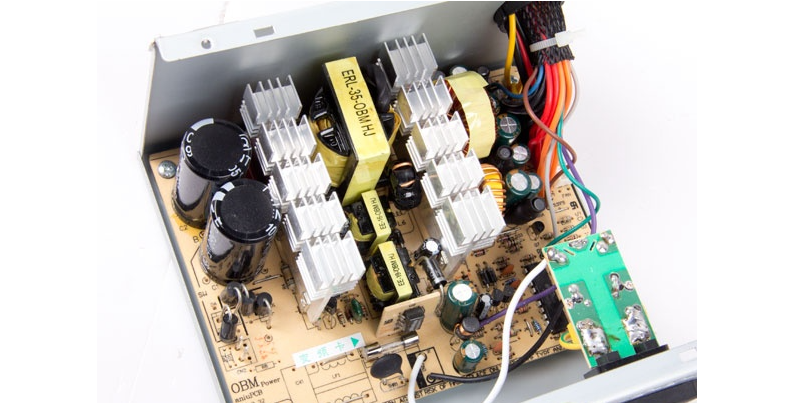

In the industrial zones on the outskirts of HuZhiMing City, a variable frequency drive (VFD) with Chinese labels adjusts electrical currents 5,000 times per second. Dubbed the "industrial pacemaker," this device is not only the control center of production lines but also a microcosm of global industrial transformation. This article explores how VFDS—a seemingly mundane product—reveal the intricate interplay of technological diffusion, geopolitical economics, and industrial upgrading.

Chapter 1: Geopolitics in the Current

1.1 The Unintended Beneficiary of the U.S.-China Trade War

Following the 2018 tariff disputes, Vietnam’s electronics sector boomed. Less known is that multinational factories like Samsung and Canon rely on Chinese VFDS for production line upgrades:

Samsung’s Hanoi Facility: Uses Huichuan MD810 VFDS to achieve ±0.001Hz speed control accuracy for 5G smartphone motherboard assembly.

Canon’s Printer Factory: Implements Inovance VFDS for 0.1-second emergency stops, reducing equipment collision incidents by 92%.

Data Paradox: 74% of industrial automation equipment imported from China to Vietnam in 2023 ultimately served U.S.-linked supply chains.

1.2 The Weaponization of Energy

Vietnam’s 2023 energy crisis highlighted VFDS’ strategic value:

Formosa Ha Tinh Steel Plant: Used VFDS to stabilize core equipment for 48 hours during grid collapse by dynamically adjusting reactive power.

Cost Realities: Japanese Toshiba’s energy storage systems were 3.7x more expensive per kWh than VFD retrofits.

Tech Competition: Chinese solutions like Huawei’s FusionSolar (integrating solar, storage, and VFDS) now dominate 85% of Vietnam’s renewable energy projects.

Chapter 2: The "Capillaries" of Technology Transfer

2.1 From Hardware Sales to Standardization

Chinese VFD manufacturers build dominance through localized service networks:

24/7 Support: Inovance stations 200 engineers in Vietnam, guaranteeing 4-hour onsite response—far outpacing Japanese competitors’ 72-hour average.

Customization: Algorithms tailored for Vietnamese coffee roasters reduce energy use by 28% while replicating traditional charcoal flavors.

Standard Influence: 62% of parameters in Vietnam’s 2023 Motor Efficiency Standards directly reference China’s GB/T protocols.

2.2 The Two-Way Dependency Trap

Beneath apparent one-way tech transfer lies mutual entanglement:

Data Flow: 60% of Vietnam’s industrial equipment data streams to China via Huawei Cloud, creating a 50TB+ Southeast Asian manufacturing database.

Talent Drain: Graduates from Ho Chi Minh City University of Technology earn 1/3 the salary of their counterparts at Chinese firms.

Remote Lockouts: Some Chinese VFDS disable operations after 30 days of unpaid fees, costing Vietnamese firms $120 million in lost orders in 2023.

Chapter 3: The Race for Alternatives

3.1 Vietnam’s "Silicon Shield" Ambition

Vietnam’s $470 million semiconductor initiative faces hurdles:

Chip Challenges: SiC power device production yields linger at 17% (vs. 85% global benchmark).

Assembly Trap: A joint venture with U.S.-based Wolfspeed handles low-value packaging/testing for 90% of projects.

Brain Drain: 58% of researchers at Vietnam’s National Semiconductor Institute were trained in China, influencing critical R&D pathways.

3.2 Japan and Korea’s Counterstrategies

Traditional industrial powers fight to reclaim influence:

Japan’s Yaskawa: Offers "free equipment + energy savings sharing" deals but demands 30% upfront deposits with 15% effective interest rates.

South Korea’s Samsung SDI: Bundles VFDs with lithium batteries, increasing total costs by 41% versus Chinese solutions.

Local Struggles: Vietnam’s Taqing Group saw 60% underutilization of Japanese VFDS due to technical expertise gaps.

Chapter 4: Industrial Evolution’s "Second Curve"

4.1 Digital Twins Redefine Production

Chinese firms are transforming VFDS into IoT gateways:

Predictive Maintenance: Inovance’s cloud platform alerts Vietnamese factories 14 days before motor failures, slashing downtime by 83%.

Carbon Tracking: Meters integrated with Inovance VFDs help Nike’s Vietnam suppliers comply with EU carbon tariffs.

Energy Monetization: Vietnamese manufacturers trade energy savings as carbon credits via Shanghai Environment Exchange.

4.2 Vietnam’s New Industrial Dilemma

At the crossroads of digital transformation, Vietnam faces hard choices:

Path Dependency: 90% of 5G+industrial IoT projects rely on Chinese hardware, risking renewed dependency.

Data Sovereignty: Vietnam’s first industrial IoT platform (developed with Huawei) stores data in Guiyang, China.

Generational Shift: Young engineers prefer Chinese MOVEX OS, stalling local industrial software development.

Conclusion: Global Order in the Current

Vietnam’s VFD procurement surge epitomizes Globalization 2.0:

Illusion of Democratization: While technology spreads, it reinforces a core-periphery hierarchy.

Efficiency vs. Sovereignty: Vietnam trades industrial autonomy for productivity gains—a fragile bargain.

Metaphor for a New Era: As Chinese VFDS regulate currents in Vietnamese factories, they recalibrate Southeast Asia’s geopolitical frequency.

In HuZhiMing City’s control rooms, the blinking LEDS of VFDS don’t just signal operational status—they transmit a coded message about power, technology, and capital in the 21st century.